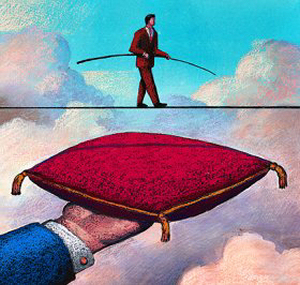

Has risk management been sidelined as firms refocus on profits and growth?

Greater complexity, poor communication, increased risk reporting requirements are taxing organizations and hampering evolution of stronger risk cultures

Rob Mitchell, Senior Editor, Economist Intelligence Unit, and Abhik Sen, Managing Editor, Economist Intelligence Unit

Has the financial services industry reached a comfort zone, placing it in jeopardy for another possible crisis? Are today’s risk management practices and reporting in tune with the existing risk culture and organizational expectations?

As risk management continues to evolve from past lessons, the biggest threat to this reform is an imbalance of risk management demands and actual programs and practices in place – so said a global risk management survey. In February and March 2011, the Economist Intelligence Unit (EIU) surveyed 315 executives globally for SAS. The survey respondents were primarily focused on risk management and represented banks, capital markets firms and insurers. Although financial institutions initiated some risk management measures to address deficiencies exposed by the financial crisis, risk cultures are ill-prepared for current demands and have been overtaken by other priorities, including growth and profitability. This renewed focus on growth and profit comes when many organizations are still developing and implementing an effective embedded risk strategy.

As risk management continues to evolve from past lessons, the biggest threat to this reform is an imbalance of risk management demands and actual programs and practices in place – so said a global risk management survey. In February and March 2011, the Economist Intelligence Unit (EIU) surveyed 315 executives globally for SAS. The survey respondents were primarily focused on risk management and represented banks, capital markets firms and insurers. Although financial institutions initiated some risk management measures to address deficiencies exposed by the financial crisis, risk cultures are ill-prepared for current demands and have been overtaken by other priorities, including growth and profitability. This renewed focus on growth and profit comes when many organizations are still developing and implementing an effective embedded risk strategy.

With the cautious overall economic recovery and relatively strong recent financial sector performance, the report shows increased risk appetites and pressure on firms to expand and boost profits. Respondents are finding it difficult to manage risk in an increasingly complex operating environment, with six out of 10 respondents citing growing complexity in the organization’s risk exposure. In addition, two-thirds of respondents say managing external risks poses a greater challenge to their institutions than internal ones. However, only 51 percent say that their risk management processes are well-placed to deal with this volatility and complexity.

Additionally, a silo-based approach to risk management continues to hamper institutions. Although the role of the risk function has elevated, financial organizations still struggle to build strong and open relationships between it and lines of business, cited as needing the most improvement. Respondents say that poor communication between departments is one of the main barriers to effective risk management – a change from last year’s report where future regulation was the top concern.

According to the survey, management boards have increased both their risk expertise and demand for risk reporting. More than four in 10 respondents indicate a rise in the board’s risk expertise, and more than half report that the board has boosted demands for risk reporting, with the retail banking sector seeing the greatest increase. Although risk reports now require more detail and comprehensiveness, only a minority of institutions, cited respondents, appear to be taking steps to upgrade risk reporting, including timeliness, consistency and extent of reporting on emerging risks.

“For effective risk management to take its place at the executive and board level, it needs to evolve from a technical support function to an intrinsic role within the strategy process,” said David Rogers, SAS Global Product Marketing Manager for Risk. “The cornerstone of this evolution requires an assimilated and comprehensive risk culture, from the top down, supported by a truly integrated risk framework, which provides both a holistic and specialized view of risk for each business level.”

Information@sme.sas.com

Sales

Sales@sme.sas.com

Technical Support

TechnicalSupport@sme.sas.com